The Great Budget Shell Game: How Missouri Politicians Hide Billions in Taxes Behind Hospital Bills

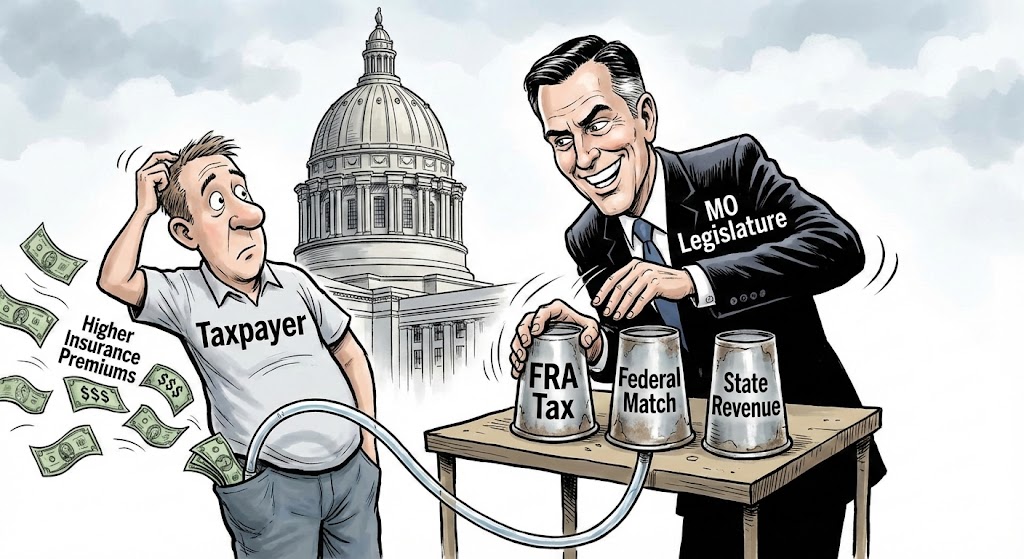

You think you know how your state government is funded: You pay income taxes, and they spend it. But in Jefferson City, there is a third cup on the table—a massive financial "shell game" that keeps the state solvent while sidestepping the spirit of Missouri’s Hancock tax limits.

It’s called the Federal Reimbursement Allowance (FRA).

On paper, it looks like a tax on hospitals. In reality, it’s a shell game that lets politicians effectively “print money” by exploiting the federal matching rules. It allows them to expand the government by billions of dollars without ever asking you for a tax hike, all while hiding the true cost in the one place you hate looking: your rising health insurance premiums.

Here is how the game is played, and why the "house" (the government) always wins.

1. The Scheme: How to Turn $1 in Taxes into $3 in Spending

Missouri relies on a set of ‘provider taxes’—collectively known as the Federal Reimbursement Allowance (FRA)—paid by hospitals, nursing homes, pharmacies, ground ambulances and managed care plans

How it works:

- The Tax: The State of Missouri charges hospitals a tax (the FRA).

- The "State Share": Instead of using your income tax dollars to fund Medicaid, the state uses this hospital tax money as its "ante" to play the federal game.

- The Match: For every ~$1 the hospitals pay in tax, the Federal Government sends roughly ~$2 in matching funds to Missouri.

- The Payback: The state takes that huge pot of combined money and pays the hospitals back for treating Medicaid patients.

The Result: FRA lets the state run a massive Medicaid program while using far less General Revenue than it otherwise would—shifting much of the state ‘share’ onto hospital/provider taxes and federal dollars. The politicians get to claim they balanced the budget.

2. The Hancock Loophole: Bypassing the Cap

You might be thinking, "If the state is collecting billions in new taxes from hospitals, doesn't that trigger the Hancock Amendment cap?"

This is the genius of the trick. The Hancock Amendment limits how much "Total State Revenue" the government can collect from Missourians.

- The Trick: The tax collected from hospitals does count toward the Hancock limit. However, the billions in federal matching funds do not.

- The Effect: By using a small amount of "tax headroom" to collect the FRA, the state unlocks a massive amount of federal spending that sits outside the Hancock cap. It allows the state government to grow dramatically in size (spending $16 billion+ on Medicaid) without technically "overtaxing" you according to the Constitution.

3. The "Hidden Tax" on Your Insurance

So why is this bad for you? If the hospitals pay the tax and the Feds match it, isn't that a win-win?

No. You are paying for it.

Hospitals are businesses. When the state slaps them with a massive FRA tax, they don't just absorb the cost. They shift it. This is known as the "Cost Shift."

"Because Medicaid often under-pays for actual costs, and because hospitals have to pay the FRA tax itself, they raise prices on private insurance patients to make up the difference."

The Consequence: Your health insurance premiums go up in part to subsidize the state budget. It is effectively a hidden tax on everyone with private health insurance, laundered through your local hospital so that state legislators don't have to vote for a tax increase.

4. Why Legislators Won't Fix It

This scheme is addictive. In 2024, the FRA was renewed through 2029 (Senate Bill 748) after a chaotic legislative battle.

- The Leverage: The FRA and related provider taxes now supply a large share of state’s own share of Medicaid costs—while federal funds cover about two-thirds of the total program. If it went away, the legislature would have to either cut Medicaid by billions (politically impossible) or raise your income taxes by billions (politically suicidal).

- The Slush Fund: By using the FRA to fund Medicaid, the legislature frees up billions in "General Revenue" to spend on other pet projects. It is the ultimate slush fund mechanism.

Conclusion

The FRA is the perfect example of how modern government operates: complex, opaque, and designed to hide the true cost of spending. By shifting the tax burden to hospitals—who then shift it to you via insurance premiums—Jefferson City can expand the size of government while claiming they "kept taxes low."